Manually calculate payroll taxes

Subtract non taxable benefits from gross pay. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

How To Calculate Payroll Taxes Methods Examples More

For example if you run payroll on the first day of every.

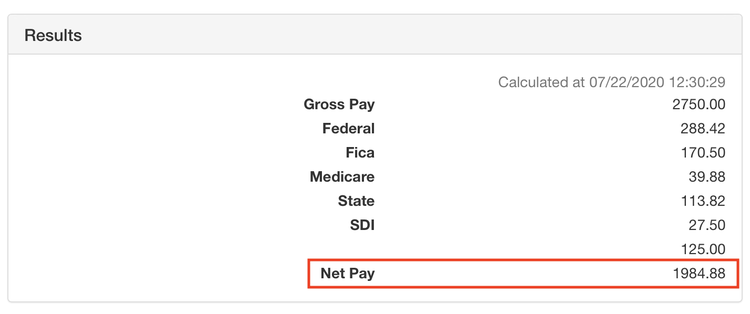

. Calculate taxes youll need to withhold and additional taxes youll owe Pay your employees by subtracting taxes and any other deductions from employees earned income Remit. Taxes Paid Filed - 100 Guarantee. Calculate Gross Pay The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be.

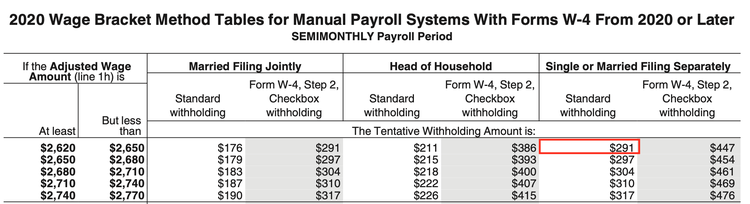

This chart can be found on the IRSgov website. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. The best part about the chart is that an Excel.

Taxes Paid Filed - 100 Guarantee. Calculate 22 Column D of the earnings that are over 44475 Column E. Manual calculation for income tax You have to deduct tax according to the claim code that corresponds to the total claim amount the employee has on Form TD1.

Best Average Rating For Customer Support. Determine how much money each employee has earned during the pay period rate of pay times hours worked and then take this. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Household Payroll And Nanny Taxes Done Easy. Download and print page 8 of Publication 15-T2022 httpswwwirsgovpubirs-pdfp15tpdffull version 2.

GetApp has the Tools you need to stay ahead of the competition. It will confirm the deductions you include on your. Fill in box 1a to 2a 3.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Income tax PAYE - Manual calculations One of the most important skills when starting out in payroll is learning how to perform manual calculations of income tax PAYE. See 2022s Top 10 Payroll Services.

Compare the Best Now. The Income Tax Withholding Assistant helps small employers manually calculate the amount of federal income tax to withhold from their employees wages for the 2020 tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Easy Tax Preparation Management. Ad Compare This Years Top 5 Free Payroll Software. Steps to calculate the 2022 tax manually 1.

Easy To Run Payroll Get Set Up Running in Minutes. This is 512050 in FIT. Well Do The Work For You.

To calculate the gross pay for a salaried employee divide their yearly salary by how many times you will run payroll during the year. Affordable Easy-to-Use Try Now. Check your payroll calculations manually.

To try it out enter the workers details in the payroll calculator and select the hourly pay rate option. Refer to the 2022. Easy To Run Payroll Get Set Up Running in Minutes.

Manually calculate payroll. Or Calculate gross salary for the period for exempt employees. Then enter the number of hours worked and the employees hourly rate.

Ad Top Quality Payroll Services Ranked By Customer Satisfaction and Expert Reviews. Get Instant Recommendations Trusted Reviews. Taxes Paid Filed - 100 Guarantee.

Free Unbiased Reviews Top Picks. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Read reviews on the premier Payroll Tools in the industry.

For example if an employee earns 1500 per week the individuals. Taxes Paid Filed - 100 Guarantee. Super Easy To Get Up and Running.

Find 10 Best Payroll Services Systems 2022. Ad Ideal For Busy Families and Budgets. The IRS provides a simple chart to follow for those who wish to manually compute their payroll.

69400 wages 46125 23275 in wages taxed at 22. Calculate gross pay regular hours overtime for each non-exempt employee. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Federal Withholding Tax Youtube

How To Calculate Taxes On Payroll Shop 57 Off Www Ingeniovirtual Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Income Tax

Solved The Purpose Of This Assignment Is To Revisit The Chegg Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2018 Federal Income Withhold Manually

How To Manage Payroll Yourself For Your Small Business Gusto

How To Calculate Payroll Taxes In 5 Steps

Federal Income Tax Fit Payroll Tax Calculation Youtube

A Small Business Guide To Doing Manual Payroll

How To Calculate Taxes On Payroll Top Sellers 57 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

A Small Business Guide To Doing Manual Payroll

How To Calculate Taxes On Payroll Store 57 Off Www Ingeniovirtual Com